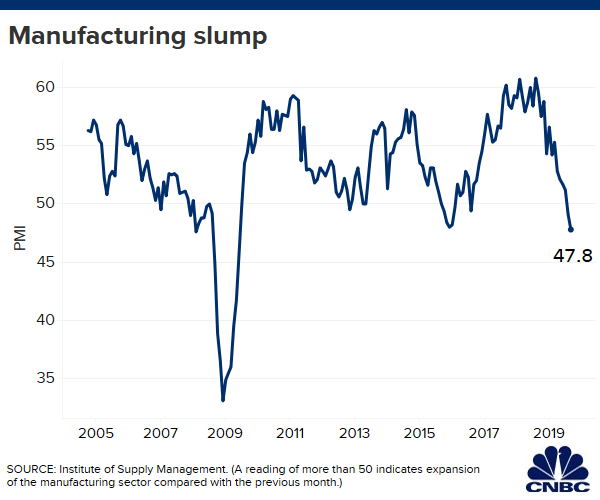

Trump targets ‘pathetic’ Federal Reserve after worst manufacturing reading in a decade

President Donald Trump again attacked the Federal Reserve on Tuesday after the weakest U.S. manufacturing reading in 10 years.

In a tweet, the president wrote Fed Chair Jerome Powell and the central bank “have allowed the Dollar to get so strong, especially relative to ALL other currencies, that our manufacturers are being negatively affected.” He contended the Fed has set interest rates “too high.”

“They are their own worst enemies, they don’t have a clue,” he wrote. “Pathetic!”

As his trade war with China rages on, Trump has repeatedly blamed the Fed’s interest rate policy for concerns about a slowing U.S. economy. He has contended the central bank has not moved quickly enough to ease monetary policy — though the Fed has cut its benchmark funds rate twice this year.

The Fed did not immediately respond to a request to comment.

Trump’s tweet comes after the Institute for Supply Management’s manufacturing reading fell to 47.8 in September, down from 49.1 in August. A reading below 50 shows a manufacturing contraction.

The poor economic data contributed to major U.S. stock indexes sliding Tuesday.

The dollar index, which measures the U.S. currency against a basket of global currencies, has climbed more than 3% this year and sits near its highest level since mid-2017. A stronger dollar relative to global currencies is generally expected to reduce exports and increase imports, hurting manufacturers because it makes their products more expensive overseas.

While exchange rates may have contributed to the drag on manufacturing in September, trade also did, according to ISM.

“Global trade remains the most significant issue as demonstrated by the contraction in new export orders that began in July 2019. Overall, sentiment this month remains cautious regarding near-term growth,” Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee, said in a release announcing the data.

Trump has repeatedly downplayed any concerns about a looming American recession. He has also contended his trade conflict with the second-largest economy in the world will not harm businesses or consumers — despite indications that it has already started to hurt some companies and worry Americans.

Seeing concerns about a flagging economy as a ploy to discredit him before the 2020 election, Trump has claimed the central bank bears the blame for any slowdown rather than his own policies.

[NBC News]

Media